GST payment

In 2022 the payment dates are as follows and are based on your 2020 return. Your goods will be released automatically when they arrive in Jersey although you wont benefit from the de minimus you.

How To Make Payment In Gst Portal Youtube

Find out what happens if your business does not submit a GST return and or pay tax due by the required date.

. OTTAWA ON Nov. Goods and Services Tax. The GST credit boost will result in recipients receiving a 50 increase on their GST payment benefits for the 2022-2023 year.

2 days agoThe Prime Minister of Canada took to Twitter on Monday to make an announcement that will affect 11 million households. Your payment will be mailed to you or. 1 day agoDoubling the GST Credit for Six Months.

Allow up to 10 working days before you contact CRA if you. 6 hours agoThe tax credit only applies to Canadians who earn 60000 or less annually. 60000 and have 3 or 4 children.

11 hours agoThe maximum payment you could receive if you are married or have a common law partner. How to pay GST. Grievance against PaymentGST PMT-07.

After filing GSTR-3 the GST Monthly Return the GST payment. Quarterly if your GST turnover is less than 20 million and we have. Tax refunds made via PayNow receiving GST and Corporate Tax refunds and GIRO will be received within 7 days from the.

In the coming weeks an estimated 11 million low- and modest-income people and families will receive an additional Goods and Services Tax. After choosing your GST online payment mode click on Make Payment. 306 if you have no children 387if you have one child 467 if you have two.

For Calculating GST Payment Due Electronic Liability Ledger should be used. Note that July 2022 to June 2023 payment will be the start of a new calendar year for GST payments and it will be based on your 2021 tax returns. You will get this payment if you were entitled to receive the GST credit in October 2022.

And in 2023 the payment dates. For example the taxable period ending 31 May is due 28 June. For example a single individual who typically gets.

To support those most affected by inflation the Government of Canada is issuing an additional 25 billion through GST credit payments to assist more than 11 million Canadian individuals. Please make sure to read terms and conditions before going ahead with GST payment online. My business is not GST-registered but is Customs-approved.

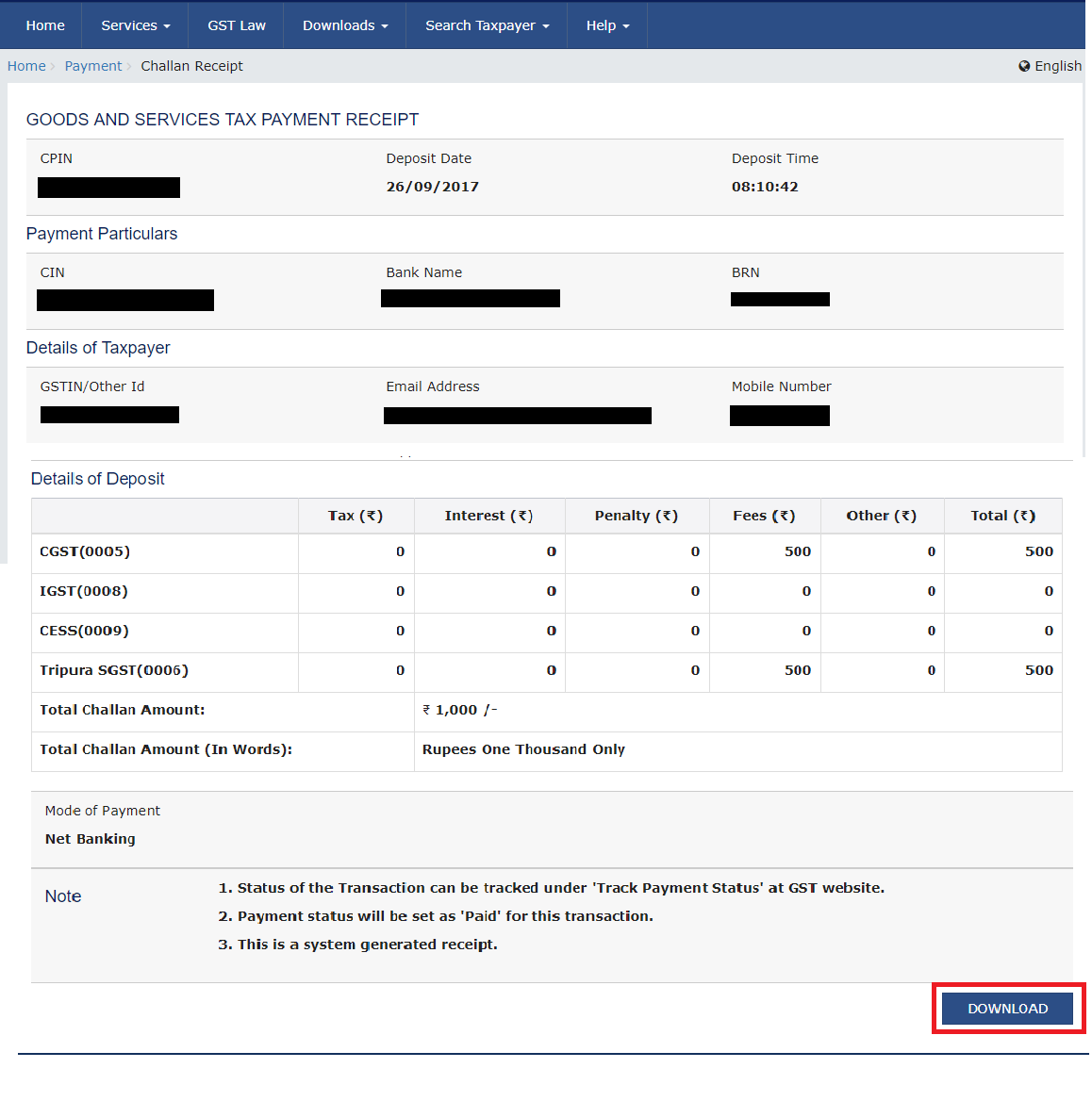

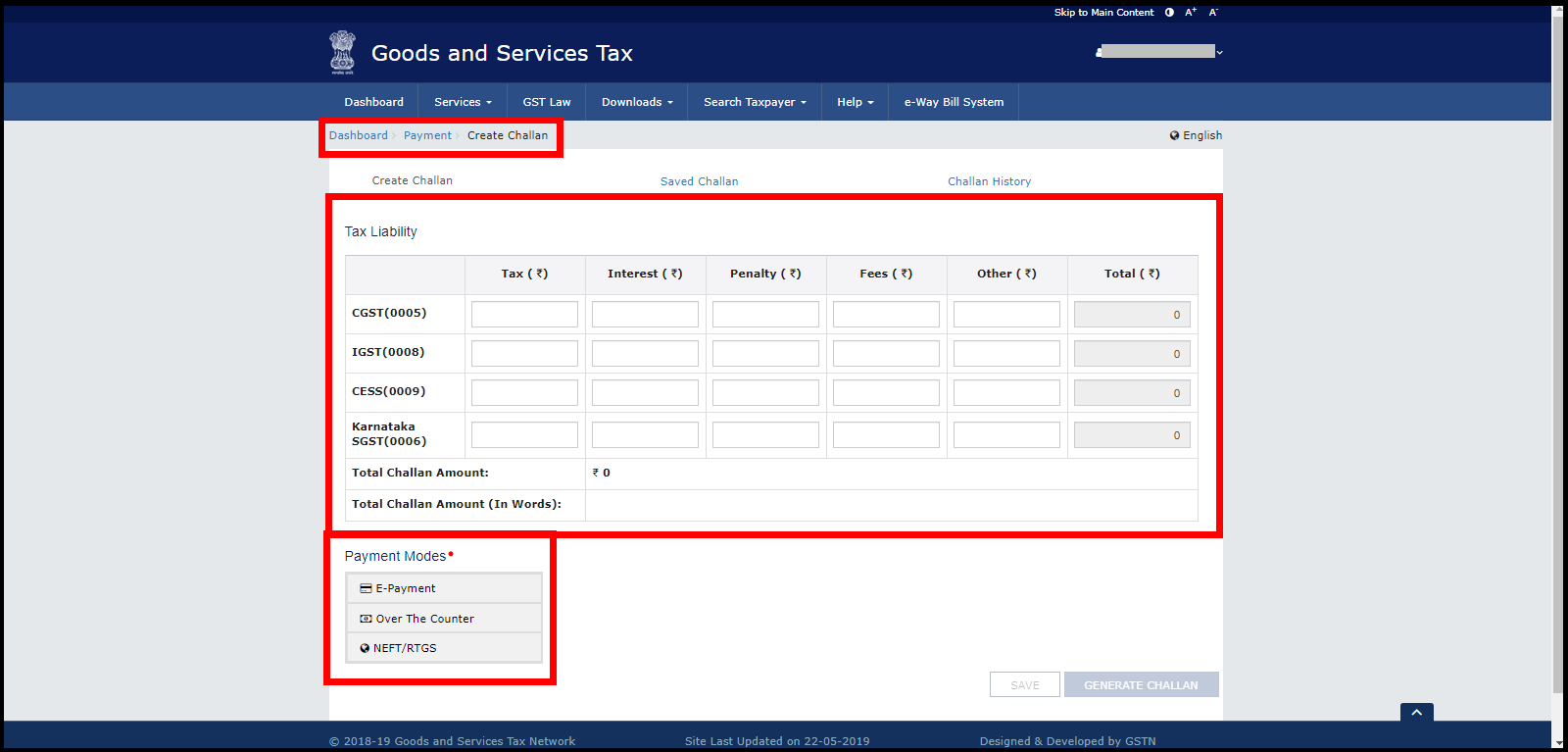

First step- login to the GST portal The second step- go to the Services menu PaymentsCreate challan or direct create. Your GST reporting and payment cycle will be one of the following. According to Trudeau for the next six months Canadians.

Generally tax credits of at least 15 are automatically refunded. Calculating GST Payment Due. 4 2022 CNW Telbec - The first of the Government of Canadas new financial support measures will take effect this Friday November 4 2022 with the.

Single Canadians qualify for a GST HST credit if you earn. Find out how you can pay your GST for imports or goods and. Monthly if your GST turnover is 20 million or more.

This is the 28th of the month after the end of your taxable period. For the 2021 base year. Typically GSTHST credit payments are made on the fifth day on or before of July October January and April.

Payments will be issued automatically starting November 4 2022. Your GST payment is due on the same day as your GST return. What are the simple steps for GST payment online.

How Do I Track My Gst Payment Status

Gst Challan Payment Process To Pay Gst Online Learn By Quicko

Gst Need To Make Additional Gst Payment Here S How To Go About It

Steps For Gst Payment Challan Through Gst Portal

How To Track Gst Payment Status Gst Payment Failures

Due Dates Of Gst Payment With Penalty Charges On Late Payment

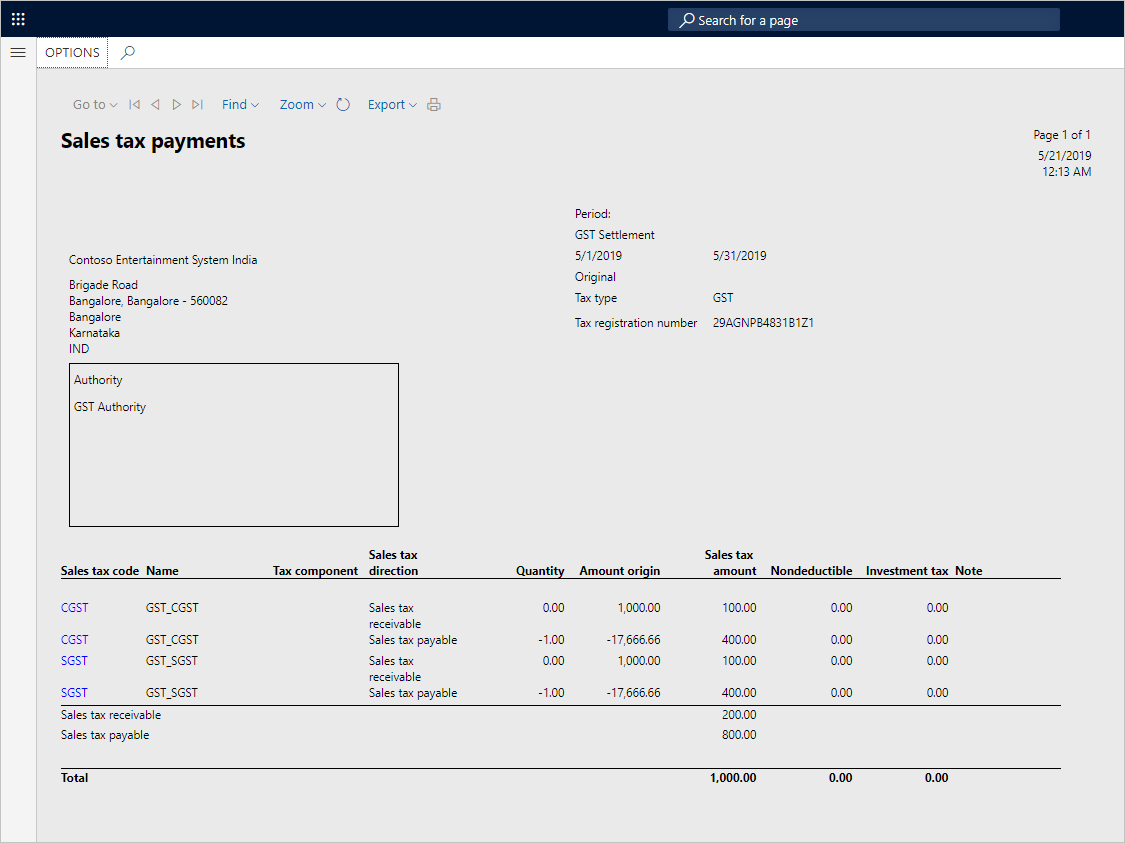

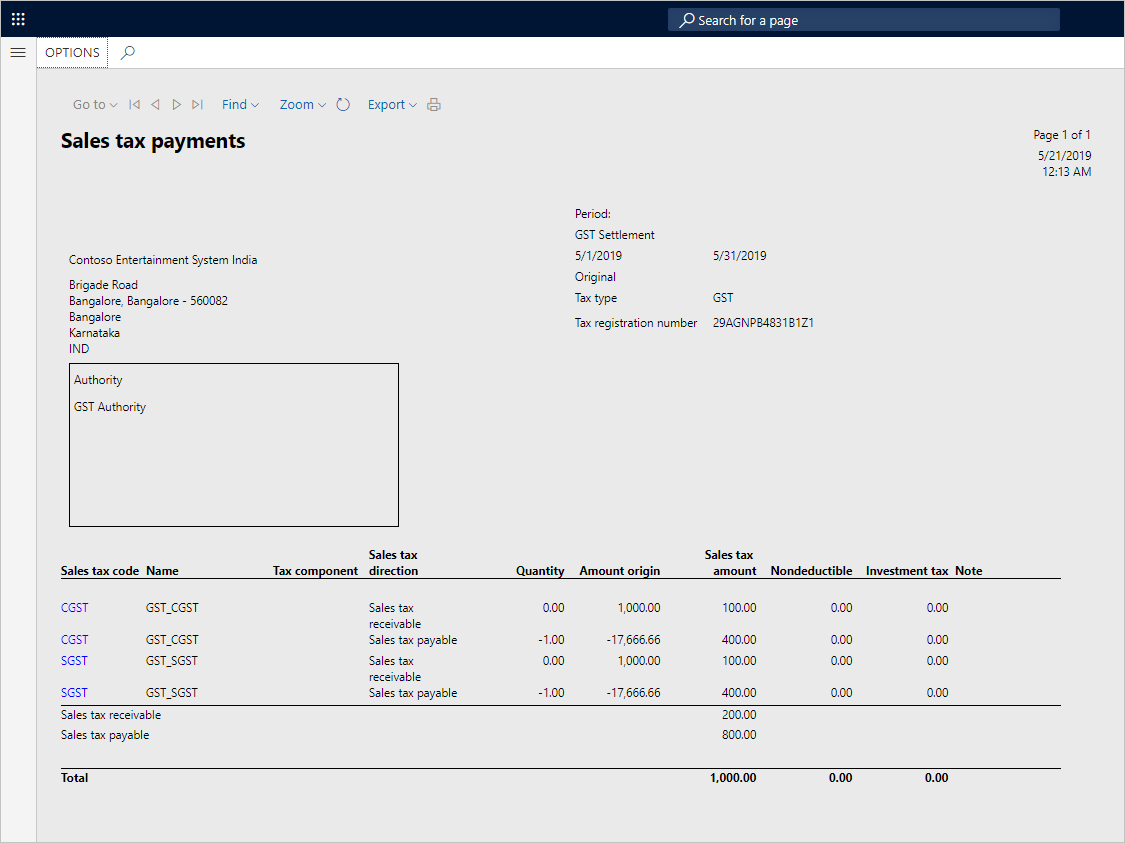

Rule Based Tax Settlement Finance Dynamics 365 Microsoft Learn

How To Deal With Late Payments Under Gst

Steps By Step Guide To Make Gst Payment Tax Payment In Gst

Gst Payment Everything You Need To Know About Gst Payments