cayman islands tax haven reddit

I hope this trend continues. AFAIK they have basically no taxes on things like income no corporate tax no capital gains tax etc.

Eu Puts Cayman Islands On Tax Haven Blacklist Repeating Islands

George Town on April 24 2008 in Grand Cayman Cayman Islands.

. A Made-in-America Offshore Tax Haven. Therefore ABC has made no profit and will pay no tax in China. How do they benefit.

The Caymans have become a popular tax haven among the American elite and large multinational corporations because there is no corporate or income tax on money. The amount of bargaining power just lost by the UK regarding the isle of man Cayman islands Jersey Bermuda and literally everywhere else is staggering. It does not offer tax incentives designed to favour non-resident individuals and businesses.

I pay corporate tax in the cayman on the 100k. These islands are a tax haven. We have broken down all 100 reasons why Cayman is not a tax haven into a four-part series.

Cayman does not meet any of the tax haven definitions set out by the OECD Transparency International or Tax Justice Network. The Cayman Islands has no income tax no corporate tax no estate or inheritance tax and no gift tax or capital gains tax making it a pure. Tax haven is a phrase that is often thrown around in the media and politics and incorrectly assigned to the Cayman Islands.

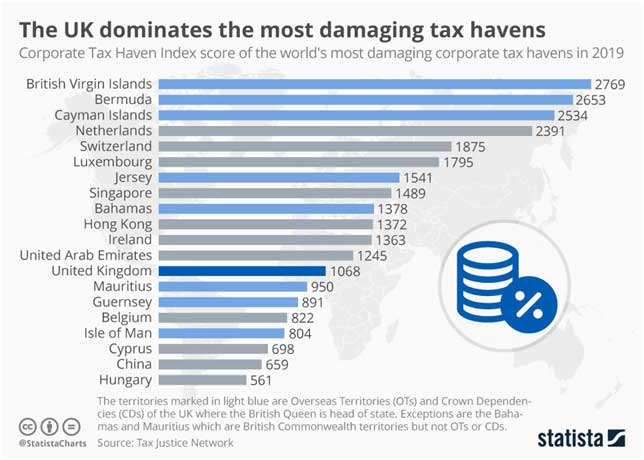

The Tax Justice Networks 2021 assessment of corporate tax havens listed the British Virgin Islands Cayman Islands and Bermuda as the top three tax. Some of the top-ranked countries in the world are tax havens such as Jersey the Cayman Islands and the Bahamas while some developed countries like the United Kingdom Australia Canada and the United States rank near the bottom of the list. It has more than 32000 offshore entities and offers a low corporate tax rate.

The Pandora Papers sheds light on the financial dealings of the elite and the corrupt and how they have used offshore accounts and tax havens to shield trillions of dollars. The Cayman Islands is a well-known tax haven where you can establish residency without much hassle and as a British Overseas Territory it offers high-quality legal services health care and education. A wealthy country where the financial sector accounts for upwards of 35 of the gross domestic product GDP Luxembourg attracts foreign investors with 0 withholding taxes and other incentives.

World Oct 10 2021. By Lynnley Browning On 090914 at 653 AM EDT. Part 1 Part 2 Part 3 and Part 4.

It just happens to be 0 but it is paid. The third-largest source of foreign investment into Israel is the Cayman Islands. JKL will then sell the product to XYZ in the USA at the retail price they want to sell there product to consumers.

Combined with the Cayman Islands tax-friendliness this stability has enticed a number of banks and Fortune 500 companies to establish. It is impossible for 70000 people to manage over 12000 hedge funds and insurance companies. To claim not a tax haven is utter nonsense.

It has a global reputation and a renowned history of offshore company. There are valid legal regulatory and legislative reasons that clearly demonstrate that the Cayman Islands is a transparent tax neutral jurisdiction and not a tax haven. The Offshore Investment Paradise.

Qatar is currently on a European Union tax haven watchlist and has a exceptionally secretive score of 77 but a tiny market share of 009 percent. Bring down the corporate tax haven network. It is easier to obtain an untraceable shell company from incorporation services though not law firms.

Both were placed on a grey list that gives authorities time to introduce legislation to address tax deficiencies identified by Brussels. What benefit do places like the Cayman Islands get for being a tax haven. 1 day agoLets be honest.

I read there are 100000 companies registered there and most are shell. In addition many of the countries used as tax havens for individual wealth are also utilized by corporations. The Cayman Islands is one of the most popular tax havens and offshore banking centres and the worlds fourth most prominent international financial centre is home to many big banks insurance companies hedge funds and accounting firms.

Each month millions of Americans send a check to Ocwen Financial Corp. So why does the Cayman Islands let themselves be used as a tax haven. In The Netherlands a company is required to pay taxes over their profits 25.

In 2010 it was calculated that Fortune 500 companies used the Netherlands 127 billion dollars 16 of our GDP. The Cayman Islands is the most notorious tax haven on earth but wants to show the world it has got nothing to hide. The Cayman Islands a British overseas territory is to be put on an EU blacklist of tax havens less than two weeks after the UKs withdrawal from the bloc.

One of the original pioneers of the Tax Haven Industry in the Cayman Islands Paul Harris was the first British chartered accountant to take up. That makes the Netherlands the biggest tax haven for American companies. In other countries such a tax is very very common.

Here are 10 things I learned while making a TV. So it opened its doors to me. In 2015 the South Pacific island state of 200000 residents was ranked the worlds most financially secretive nation in a list of tax havens compiled by the Tax Justice Network.

Zero income tax has led to an increasing class society with those at the bottom mostly Caymanian struggling. The statuses of the Cayman Islands and the British Virgin Islands both overseas British territories were up for review by the EU this month. I open a corporate account on crypto exchanges they allow cayman island corps already checked Lets say I make 100000 in a year random numbers for reference.

Therefore when XYZ buys the product off JKL they make a profit in the Cayman Islands were little or no company income tax is paid. Tax Laws in the Cayman Islands. Last year the UK and its Corporate tax haven network was judged to be by far the worlds greatest enabler of corporate tax avoidance by the Tax Justice Network.

Likewise the UAE has reportedly become a tax haven for Africas ultra-wealthy. I open a bank account in the cayman with that corporation.

Pandora Papers Reveal South Dakota S Role As 367bn Tax Haven Us News The Guardian

The World S Biggest Private Tax Havens R Europe

Le Tax Haven Has Arrived R Dogelore

Swissleaks The Map Of The Globalized Tax Evasion Swiss Bank Data Visualization Map

The Tax Havens Attracting The Most Foreign Profits R Europe

Seasteading Tax Havens For The Rich The Seasteading Institute

Oecd Says New Deal Will End Tax Havens Cns Business

Why Doesn T The Eu Consider Luxembourg A Tax Haven Euronews

Us And Uk Are Among The Safest Tax Havens In The World Peoples Dispatch

/CIA_map_of_the_Caribbean-822e94431d4647ba9ca350ebf28eb23b.png)

Top 10 Offshore Tax Havens In The Caribbean

Report Highlights Practice Of Offshore Tax Havens Ct News Junkie

Haven Is A Place On Earth The Nib Tax Haven Haven Earth

Tax Havens Explained How The Rich Hide Money Offshore Cbc News

Cayman To Be Added To Eu Tax Haven Blacklist Commercial Risk

The Cost Of Tax Havens Tax Haven Developing Country Infographic